Ensure That You’re Insured

Health Insurance Services

Medicare

Medicare is a health insurance program for: People age 65 or older, people under age 65 with certain disabilities, or people of all ages with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a kidney transplant).

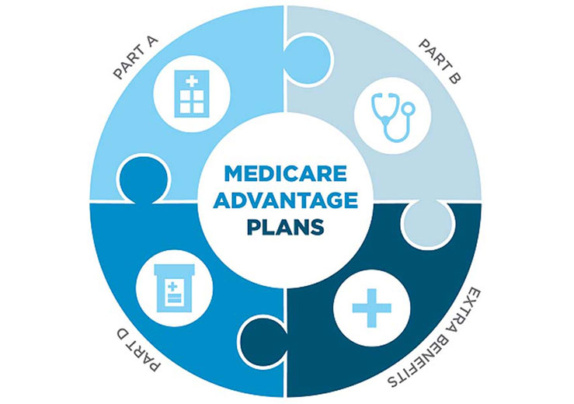

Medicare Advantage

Medicare Advantage Plans are a type of Medicare health plan offered by a private company that contracts with Medicare to provide all your Part A and Part B benefits. Most Medicare Advantage Plans also offer prescription drug coverage. If you’re enrolled in a Medicare Advantage Plan, most Medicare services are covered through the plan. Your Medicare services aren’t paid for by Original Medicare.

Prescription Drug Plans

Medicare prescription drug coverage is an optional benefit offered to everyone who has Medicare. To get Medicare drug coverage, you must join a Medicare plan that offers prescription drug coverage. Each plan can vary in cost and drugs covered.

Accident Insurance

Accident Insurance, also known as supplemental accident insurance or personal accident insurance, pays benefits for accidental injuries.

Health Insurance Plans for Individuals, Families, and Groups

If you’re looking for individual or family health insurance prior to age 65, we offer many choices to fit your needs. We also offer Group Health insurance which helps businesses pay for health care expenses for their employees.

Secure Your Future

Financial Services

Life Insurance (Individual & Group)

Individual Life Insurance is an individual policy that is owned by you, and you can take it with you into retirement. You pay a premium rate based on your age at the time of application. Although premiums are higher initially, they do not increase due to age, nor does your coverage reduce due to age. Group Term Life Insurance is a policy intended to last during your working years only. It is a policy that is not an individual contract but one that is owned by your employer.

Term & Permanent Life Insurance

There are two basic life insurance options: term and permanent. Term lasts for a specific, pre-set period. Permanent lasts your entire lifetime. Depending on your needs, you may want the affordability of term life which is most often used for temporary, short-term needs like your mortgage. Or, you may prefer the lifelong protection and cash value that most permanent life insurance products offer.

Annuities

Annuities are insurance contracts that promise to pay you regular income either immediately or in the future. You can buy an annuity with a lump sum or a series of payments. The income you receive from an annuity is taxed at regular income tax rates, not capital gains rates, which are usually lower.

Retirement Solutions

The best retirement plans can help you build your nest egg. But given the different features and benefits of the various types of IRAs and 401(k) plans, it can be a challenge to find the right one for you and your situation. The good news is that you can have more than one.

Final Expense Insurance

Final expense insurance is designed to cover the bills that your loved ones will face after your death. These costs will include medical bills and funeral expenses. Final expense insurance is also known as burial insurance.

Funeral Plans

Pre-paid funeral plans provide a way for people to pay for their funeral arrangements before they pass. It’s for people who want to spare their loved ones from having to make decisions and experience financial stress while grieving.